Unit cost depreciation formula

The assumption in this depreciation method is that the annual cost of depreciation is the fixed percentage 1 - K of the Book Value BV at the beginning of the year. An example of Depreciation If a delivery truck is purchased by a company with a cost of Rs.

Activity Method Of Depreciation Explanation Formula Examples Accounting For Management

After the initial decrease the marginal cost Marginal Cost Marginal cost formula helps in calculating the value of increase or decrease of the total production cost of the company during the period under consideration if there is a change in output by one extra unit.

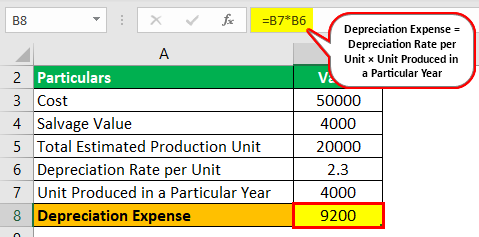

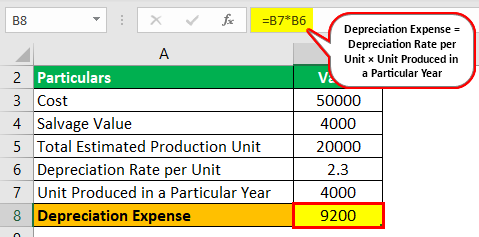

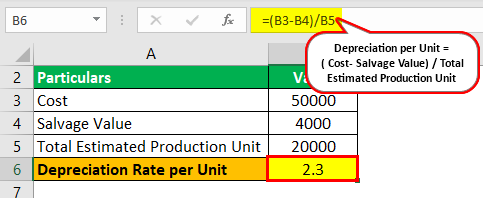

. Read more yellow line starts to. They also produce gizmos at a variable cost of 5unit and whatsits for 20unit. Per Unit Depreciation Assets Cost Salvage Value Useful life of each unit.

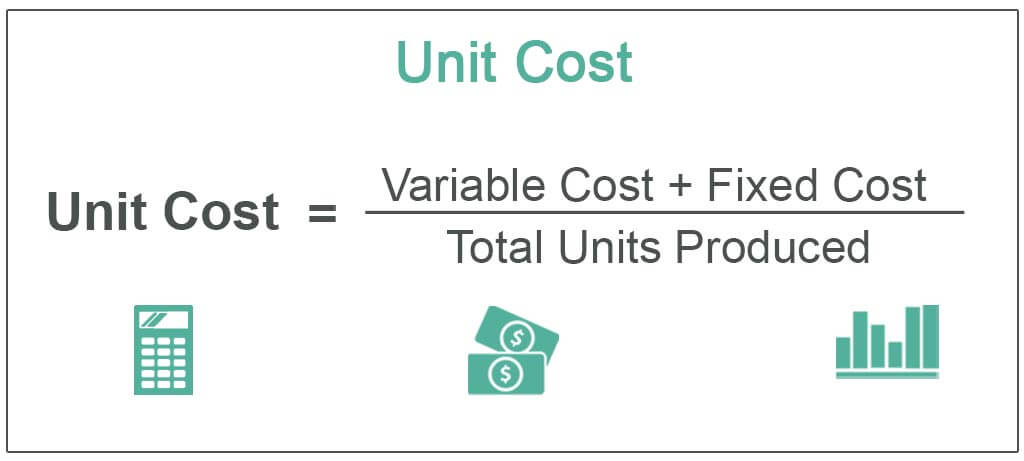

100000 and the expected usage of the truck are 5 years the business might depreciate the asset under depreciation expense as Rs. Depreciation Asset Cost Residual Value Useful Life of the Asset. This concept is most commonly used in the manufacturing industry and is calculated by adding fixed and variable expenses and dividing it by the total number of units produced.

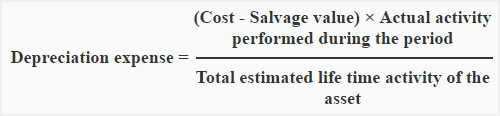

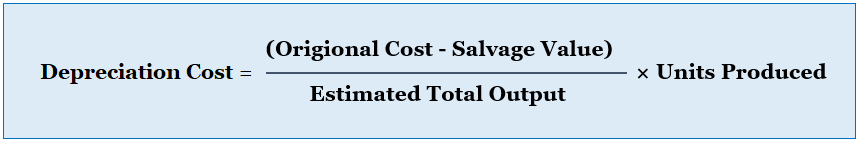

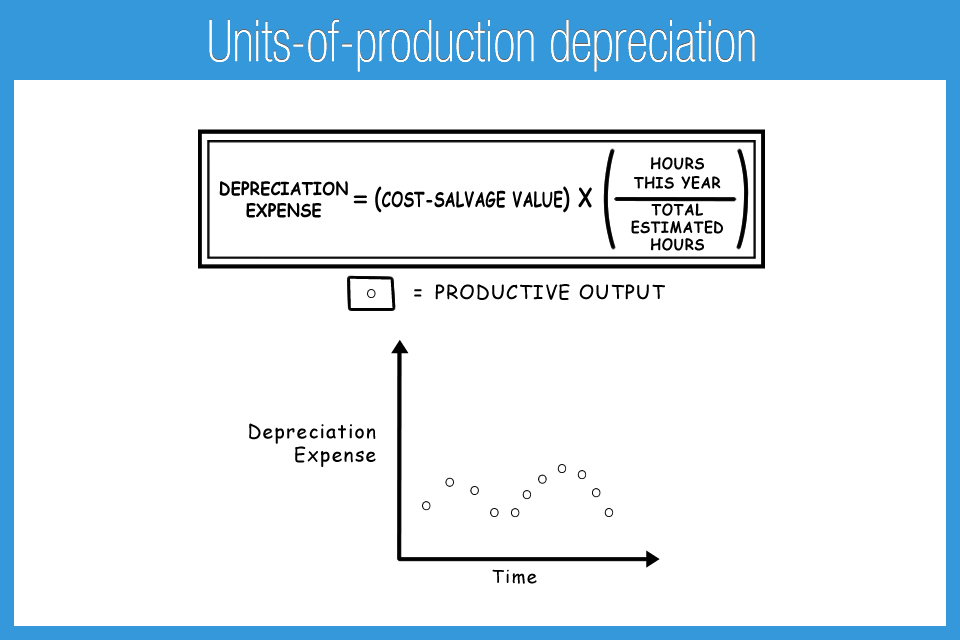

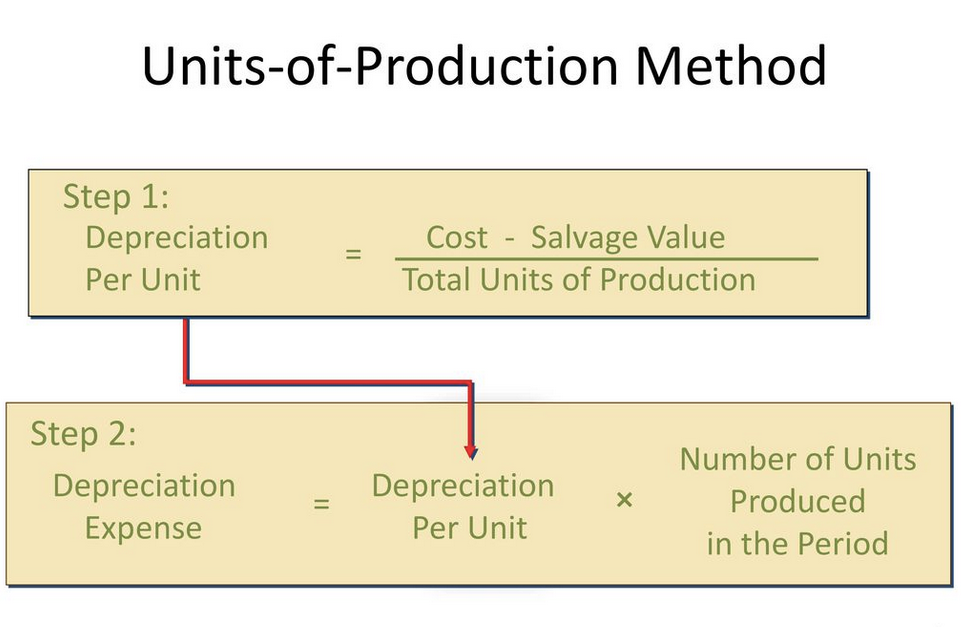

Using the formula from above. They produce 25 widgets 50 gizmos and 15 whatsits. The following additional steps can be used to derive the formula for depreciation under the unit of production method.

Declining Balance Method is sometimes called the Constant-Percentage Method or the Matheson formula. Produces widgets at a variable cost of 10unit. So determine the life-time production capacity of the asset in terms of units.

Life-time production capacity indicates the total no. It is calculated by dividing the change in the costs by the change in quantity. Unit Cost is the total cost fixed and variable incurred by the company to produce store and sell one unit of a product or service.

Finally the Depreciation expense is calculated by applying the estimated values in the below formula. 20000 every year for a period of 5 years. Double Declining Balance Method.

Cost-Volume Profit Analysis. The formulas for Declining Balance Method of Depreciation are. Creditors and investors also use cost of goods sold to calculate the gross margin of the business and analyze what percentage of revenues is available to cover operating expenses.

Average Variable Cost 10 X 25 5 X 50 20 x 15 90 Average Variable Cost 250 250 300 90. The COGS formula is particularly important for management because it helps them analyze how well purchasing and payroll costs are being controlled. Cost-volume profit CVP analysis is based upon determining the breakeven point of cost and volume of goods and can be useful for managers making short-term economic.

Total Depreciation Per Unit Depreciation Total number of Units Produced.

Activity Based Depreciation Method Formula And How To Calculate It Accounting Hub

Units Of Production Depreciation

2

Units Of Activity Depreciation Calculator Double Entry Bookkeeping

Unit Of Production Depreciation Method Formula Examples

Depreciation Formula Calculate Depreciation Expense

Unit Of Production Depreciation Method Formula Examples

Depreciation Of Assets 1 Of 3 Flat Rate Depreciation Youtube

Depreciation Formula Examples With Excel Template

Units Of Production Depreciation Accounting Play Learning App

Unit Of Production Depreciation Method Formula Examples

Calculating Depreciation Unit Of Production Method

Depreciation Expense Calculator Factory Sale 56 Off Www Ingeniovirtual Com

How To Calculate Depreciation Expense Using Units Of Production Method Wikiaccounting

Depreciation Formula Examples With Excel Template

Unit Cost Depreciation General Formula Youtube

Unit Cost Meaning Formula Step By Step Calculation